Compounding is the process where the returns earned on an investment are reinvested, allowing them to earn returns themselves. The longer the period of compounding, the greater the impact on the overall return. The concept of compounding applies to mutual funds in the following ways:

Reinvestment of dividends: Mutual funds invest in a portfolio of stocks or bonds, and the returns earned by the fund are distributed among the investors as dividends. By reinvesting these dividends, investors can benefit from compounding, as the reinvested amount earns returns as well.

Capital appreciation: Mutual funds also generate returns through capital appreciation, which is the increase in the value of the underlying securities in the portfolio. When these gains are reinvested, they contribute to the overall growth of the investment.

Long-term investing: Mutual funds are designed to be held for the long-term, allowing investors to benefit from the power of compounding. Over time, the compounding effect can significantly increase the value of an investment.

The concept of compounding is a key factor in the success of mutual funds. By reinvesting returns, investors can maximize their returns and achieve their financial goals. Compounding means you not only receive the interest on the amount that you have invested, but also on the interest that keeps getting added to it. It is a technique of making your money work harder for you. Although we generally associate ‘interest’ to the process of compounding, it actually applies equally to all forms of returns, not just those that are called interest. This simple but powerful concept of investing acts as a multiplier in your investment portfolio. There are two things that are required for our investments to grow time and returns. The more of either of these two things an investment gets, the more it grows. Many investors don’t see their wealth grow because they fail to give either sufficient time for the growth or they invest in something that doesn’t give sufficient returns, given their goals.

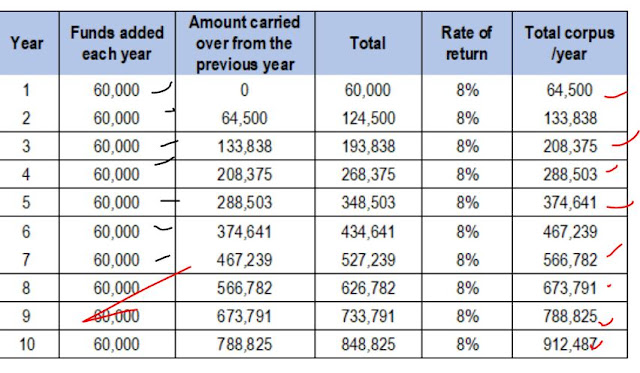

Compounding in terms of mutual funds:

Let’s say you invest Rs.5,000 in the first month. In exchange for this amount, you receive 50 units of the mutual fund, each of which is worth Rs100 or simply the NAV is Rs100. For keeping things simple, I am not including taxes and other charges levied on the investor. Suppose after a month, each unit is worth Rs120. So effectively, the value of your investments will be 50x120=6,000. So, you have earned a return of 20% on your investment. This is basically how you earn on your mutual fund investment.

Now, let us see the effect of compounding in this mutual fund investment. Let us assume you continue to invest Rs5,000 every month for ten years conservatively in a debt mutual fund. Now, the money that you invested in the first year has grown the most as it has had ten years to grow. This is compounding in action. If you look at the table above, you can see, each year the interest is on not just that year’s investment but on the previous years’ as well. With each year, the principal goes up and so does the amount you earn. From this, we can conclude that the best way to take benefit of compounding is to start saving and investing wisely as early as possible. The earlier you start investing, the greater will be the power of compounding.